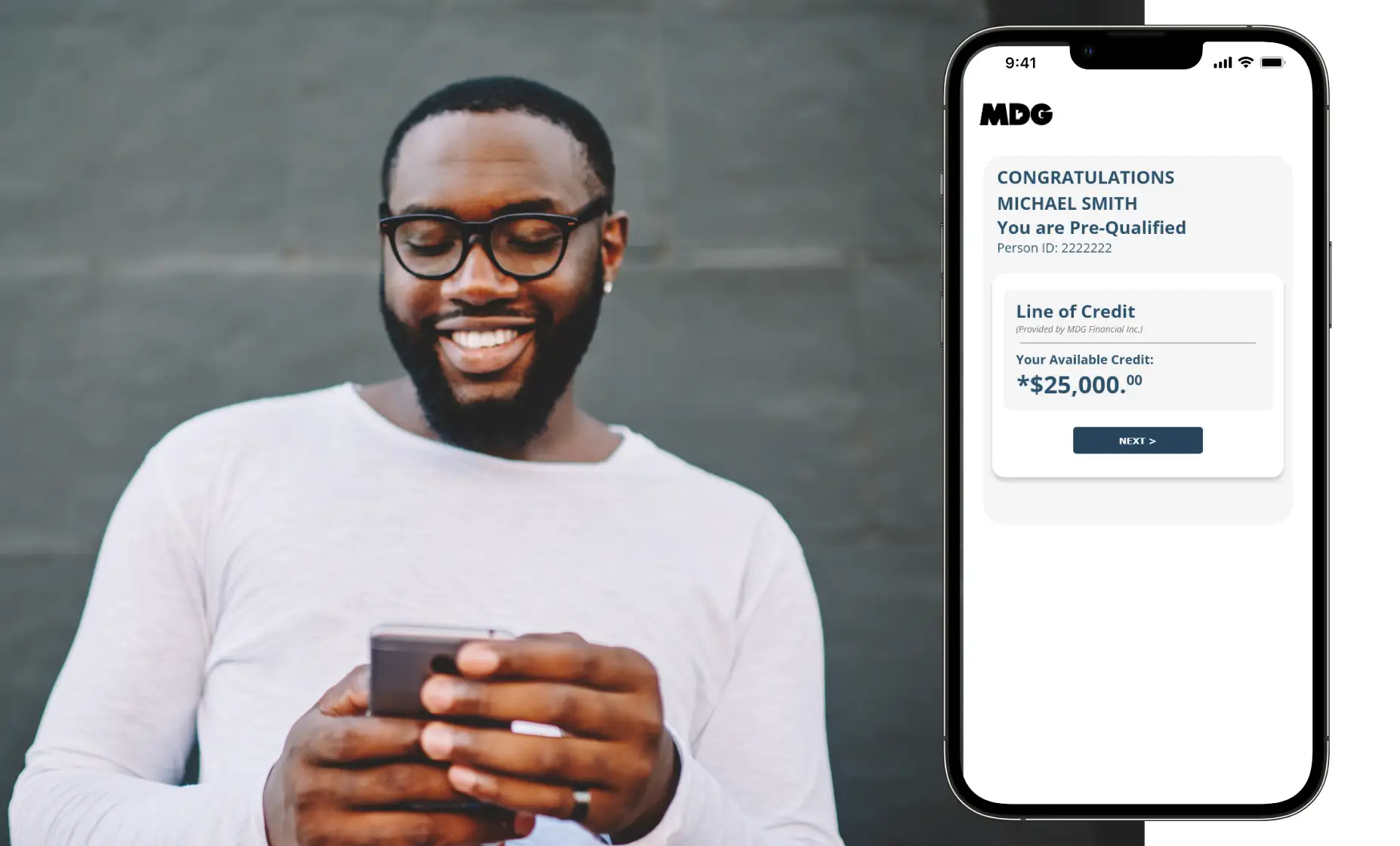

MDG Financial could approve a larger customer base. Giving more people access to flexible payment plans to finance your products and/or services. Gain incremental sales and boost your profitability instantly. Your clients could be pre-approved for up to $25,000.

50% More

Stop Leaving Money on the Table

Other lenders might reject up to 50% of applications. MDG Financial could prequalify majority of those rejections for a credit account.

33%

Lower Acquisition Cost

You’ve already invested in generating those leads. By approving more customers, you lower your cost of acquisition, making your marketing budget go further.

Examples are for Illustration Purposes.

Full Credit Spectrum—Plus Dealer Rebates

> We consider every credit profile, from the worst to the best.

> Dealer Rebates for good-credit customers — get paid on sales where other lenders pay you nothing.

Zero Risk, Only Gain

> Keep your current financing setup exactly as it is. MDG Financial will be your alternative lender.

> Just pass your rejects to MDG Financial — we assess and we could prequalify them. Give your profits a huge lift (boost your profits). Never lose a sale again.

> Recover Your Marketing Investment: You've already paid to generate those leads. Don't let them go to waste. MDG could convert them into paying customers.

Tap Into Millions of New Clients

> Customers who were previously denied could be approved by MDG Financial. Give your clients a viable alternative. Once their approved, we'll make arrangements with you to settle their invoice.

> Repeat purchases - a revolving line of credit enables your clients to use your services or purchase your products repeatedly. Large projects paid out in different phases, is easier to manage and budget for.

> Other lenders may reject up to 50% of applications, but MDG could prequalify the majority of those rejections for a credit account, increasing your approval rate.

> For illustration purposes only, with 1,000 approvals and an acquisition cost of $100 per customer, the revenue is $1,000,000. A 50% increase in approvals adds 500 more customers, bringing the total to 1,500 approvals and $1,500,000 in revenue. This results in a reduced Cost of Acquisition (COA) from $100 per customer to $66.67 per customer.

How It Works?

1. Email the quote/invoice to your customer. They will get a link to the to fill out the application.

2. Customers are notified their pre-prequalification amount within minutes. They could be pre-approved for up to $25,000.

3. Once the sale is completed, MDG Financial will transfer you the payment for the invoice/receipt.

4. It's a win-win solution for both you and the customer. Financing makes life instantly more manageable and affordable.

5. We extend credit to more people than other lenders. Every eligible person could be considered for up to $25,000.

Submit your recently declined applications. Find out how many could be approved.

This assessment is completely free and comes with no obligation.

More Approvals = More Revenue

Seamless Integration = Zero Hassles

Repeat Buyers = Long-Term Profit

Contact MDG Financial now. Start closing deals that no other lender could approve — at zero risk to you!